How To Add A New Baby To Child Tax Credit . if you have a child, you might be able to cut your tax bill by using the newly enhanced child tax credit. Individual income tax return, and. you can claim the child tax credit by entering your children and other dependents on form 1040, u.s. for the 2023 tax year, you can get a maximum tax credit of $2,000 for each qualifying child under age 17—although there is an income limit of $400,000 for. Here's how to add a newborn to child tax credit. both the child tax credit eligibility assistant and child tax credit update portal are available now on irs.gov. all children under 18 are eligible for the child tax credit. See if you qualify using the child tax credit eligibility assistant. But if you're having a baby in 2021, you won't get the money until later. If you don't normally file a return, register with the irs.

from www.becker.com

all children under 18 are eligible for the child tax credit. for the 2023 tax year, you can get a maximum tax credit of $2,000 for each qualifying child under age 17—although there is an income limit of $400,000 for. Individual income tax return, and. See if you qualify using the child tax credit eligibility assistant. if you have a child, you might be able to cut your tax bill by using the newly enhanced child tax credit. But if you're having a baby in 2021, you won't get the money until later. both the child tax credit eligibility assistant and child tax credit update portal are available now on irs.gov. If you don't normally file a return, register with the irs. you can claim the child tax credit by entering your children and other dependents on form 1040, u.s. Here's how to add a newborn to child tax credit.

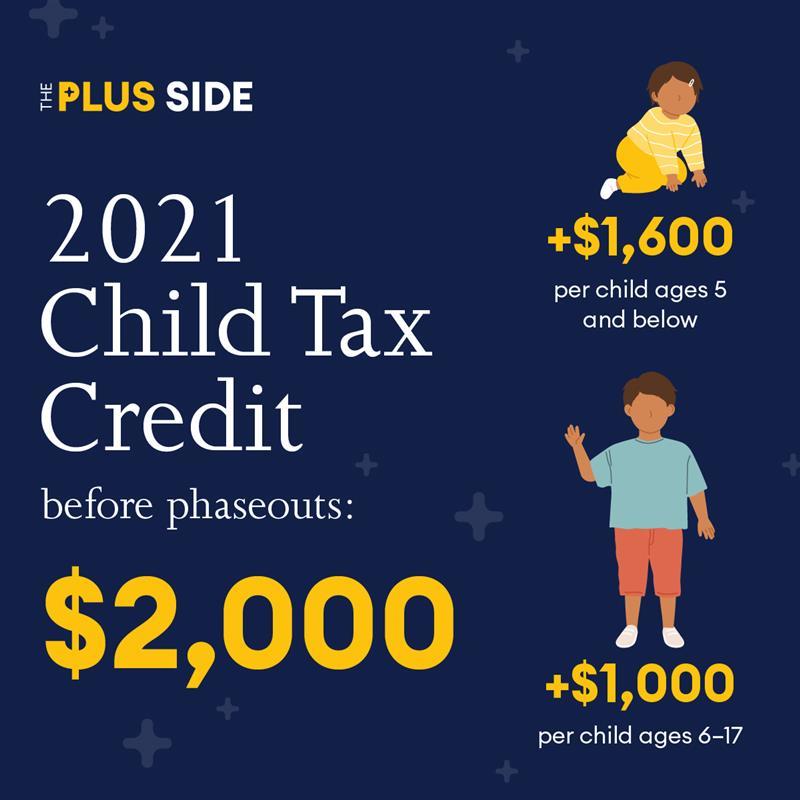

The Expanded 2021 Child Tax Credit Tax Credits Becker

How To Add A New Baby To Child Tax Credit See if you qualify using the child tax credit eligibility assistant. you can claim the child tax credit by entering your children and other dependents on form 1040, u.s. If you don't normally file a return, register with the irs. both the child tax credit eligibility assistant and child tax credit update portal are available now on irs.gov. if you have a child, you might be able to cut your tax bill by using the newly enhanced child tax credit. But if you're having a baby in 2021, you won't get the money until later. See if you qualify using the child tax credit eligibility assistant. for the 2023 tax year, you can get a maximum tax credit of $2,000 for each qualifying child under age 17—although there is an income limit of $400,000 for. all children under 18 are eligible for the child tax credit. Here's how to add a newborn to child tax credit. Individual income tax return, and.

From www.youtube.com

Costly TaxFiling Mistake 12 to Claim your New Baby as a Child Tax Credit Dependent How To Add A New Baby To Child Tax Credit See if you qualify using the child tax credit eligibility assistant. But if you're having a baby in 2021, you won't get the money until later. you can claim the child tax credit by entering your children and other dependents on form 1040, u.s. if you have a child, you might be able to cut your tax bill. How To Add A New Baby To Child Tax Credit.

From flyfin.tax

Understanding the Child Tax Credit FlyFin How To Add A New Baby To Child Tax Credit all children under 18 are eligible for the child tax credit. both the child tax credit eligibility assistant and child tax credit update portal are available now on irs.gov. for the 2023 tax year, you can get a maximum tax credit of $2,000 for each qualifying child under age 17—although there is an income limit of $400,000. How To Add A New Baby To Child Tax Credit.

From apsbb.org

Child Tax Credit 2023 Limit, Eligibility, Calculator APSBB How To Add A New Baby To Child Tax Credit all children under 18 are eligible for the child tax credit. Here's how to add a newborn to child tax credit. if you have a child, you might be able to cut your tax bill by using the newly enhanced child tax credit. See if you qualify using the child tax credit eligibility assistant. both the child. How To Add A New Baby To Child Tax Credit.

From www.nbcdfw.com

What to Know About New Child Tax Credits Starting in July NBC 5 DallasFort Worth How To Add A New Baby To Child Tax Credit you can claim the child tax credit by entering your children and other dependents on form 1040, u.s. If you don't normally file a return, register with the irs. Here's how to add a newborn to child tax credit. But if you're having a baby in 2021, you won't get the money until later. for the 2023 tax. How To Add A New Baby To Child Tax Credit.

From besttabletsforkids.org

How to apply for the 2023 Child Tax Credit? 2024 How To Add A New Baby To Child Tax Credit Individual income tax return, and. for the 2023 tax year, you can get a maximum tax credit of $2,000 for each qualifying child under age 17—although there is an income limit of $400,000 for. all children under 18 are eligible for the child tax credit. if you have a child, you might be able to cut your. How To Add A New Baby To Child Tax Credit.

From www.europeanjournalofscientificresearch.com

3,600 Child Tax Credit Per Child For US Know your Eligibility and How you Claim in 2024 How To Add A New Baby To Child Tax Credit all children under 18 are eligible for the child tax credit. you can claim the child tax credit by entering your children and other dependents on form 1040, u.s. But if you're having a baby in 2021, you won't get the money until later. See if you qualify using the child tax credit eligibility assistant. If you don't. How To Add A New Baby To Child Tax Credit.

From governmentassistanceonline.com

Understanding the Child Tax Credit Government Assistance Online How To Add A New Baby To Child Tax Credit Here's how to add a newborn to child tax credit. if you have a child, you might be able to cut your tax bill by using the newly enhanced child tax credit. See if you qualify using the child tax credit eligibility assistant. Individual income tax return, and. both the child tax credit eligibility assistant and child tax. How To Add A New Baby To Child Tax Credit.

From www.tldraccounting.com

Child and Dependent Care Expenses Tax Credit TL;DR Accounting How To Add A New Baby To Child Tax Credit all children under 18 are eligible for the child tax credit. Individual income tax return, and. both the child tax credit eligibility assistant and child tax credit update portal are available now on irs.gov. for the 2023 tax year, you can get a maximum tax credit of $2,000 for each qualifying child under age 17—although there is. How To Add A New Baby To Child Tax Credit.

From familymagazine.co

Child Tax Credits Explained Family Magazine How To Add A New Baby To Child Tax Credit for the 2023 tax year, you can get a maximum tax credit of $2,000 for each qualifying child under age 17—although there is an income limit of $400,000 for. See if you qualify using the child tax credit eligibility assistant. both the child tax credit eligibility assistant and child tax credit update portal are available now on irs.gov.. How To Add A New Baby To Child Tax Credit.

From www.adkf.com

Advanced Child Tax Credit ADKF How To Add A New Baby To Child Tax Credit See if you qualify using the child tax credit eligibility assistant. But if you're having a baby in 2021, you won't get the money until later. If you don't normally file a return, register with the irs. Here's how to add a newborn to child tax credit. for the 2023 tax year, you can get a maximum tax credit. How To Add A New Baby To Child Tax Credit.

From www.clearoneadvantage.com

Child Tax Credit 2021 A Quick Guide ClearOne Advantage How To Add A New Baby To Child Tax Credit If you don't normally file a return, register with the irs. for the 2023 tax year, you can get a maximum tax credit of $2,000 for each qualifying child under age 17—although there is an income limit of $400,000 for. Here's how to add a newborn to child tax credit. all children under 18 are eligible for the. How To Add A New Baby To Child Tax Credit.

From goqbo.com

Advancements in the Child Tax Credits Quality Back Office How To Add A New Baby To Child Tax Credit If you don't normally file a return, register with the irs. See if you qualify using the child tax credit eligibility assistant. you can claim the child tax credit by entering your children and other dependents on form 1040, u.s. But if you're having a baby in 2021, you won't get the money until later. if you have. How To Add A New Baby To Child Tax Credit.

From medium.com

Child Tax Credit 2024. Child Tax Credit 2024 by IRS Fresh Start Initiative Feb, 2024 Medium How To Add A New Baby To Child Tax Credit Individual income tax return, and. if you have a child, you might be able to cut your tax bill by using the newly enhanced child tax credit. See if you qualify using the child tax credit eligibility assistant. both the child tax credit eligibility assistant and child tax credit update portal are available now on irs.gov. for. How To Add A New Baby To Child Tax Credit.

From www.moneybestpal.com

Additional Child Tax Credit How To Add A New Baby To Child Tax Credit for the 2023 tax year, you can get a maximum tax credit of $2,000 for each qualifying child under age 17—although there is an income limit of $400,000 for. you can claim the child tax credit by entering your children and other dependents on form 1040, u.s. both the child tax credit eligibility assistant and child tax. How To Add A New Baby To Child Tax Credit.

From www.insuranceblogbychris.com

7 Important Money Matters Every New Mom Like the Child Tax Credit! How To Add A New Baby To Child Tax Credit both the child tax credit eligibility assistant and child tax credit update portal are available now on irs.gov. Individual income tax return, and. all children under 18 are eligible for the child tax credit. Here's how to add a newborn to child tax credit. But if you're having a baby in 2021, you won't get the money until. How To Add A New Baby To Child Tax Credit.

From www.the-sun.com

Child tax credits 2021 and 2022 What to do if you didn’t get your payment The US Sun How To Add A New Baby To Child Tax Credit you can claim the child tax credit by entering your children and other dependents on form 1040, u.s. Here's how to add a newborn to child tax credit. both the child tax credit eligibility assistant and child tax credit update portal are available now on irs.gov. if you have a child, you might be able to cut. How To Add A New Baby To Child Tax Credit.

From www.financestrategists.com

Additional Child Tax Credit Meaning, Process, Pros and Cons How To Add A New Baby To Child Tax Credit both the child tax credit eligibility assistant and child tax credit update portal are available now on irs.gov. all children under 18 are eligible for the child tax credit. If you don't normally file a return, register with the irs. you can claim the child tax credit by entering your children and other dependents on form 1040,. How To Add A New Baby To Child Tax Credit.

From trp.tax

The New Child Tax Credit Proposal Versus the Old How To Add A New Baby To Child Tax Credit If you don't normally file a return, register with the irs. But if you're having a baby in 2021, you won't get the money until later. Here's how to add a newborn to child tax credit. all children under 18 are eligible for the child tax credit. both the child tax credit eligibility assistant and child tax credit. How To Add A New Baby To Child Tax Credit.